Original Source: EMN

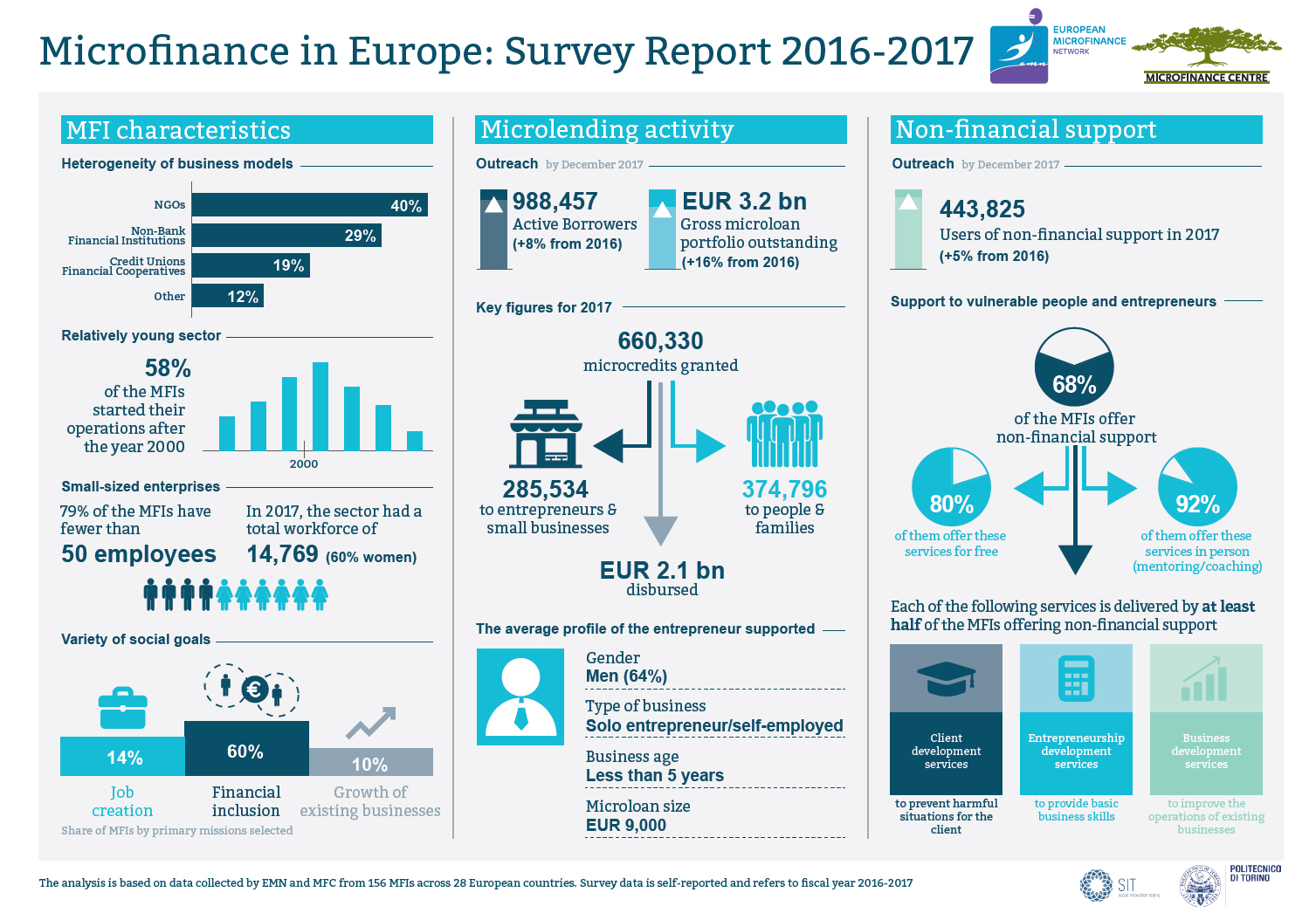

This 8th edition of the European Microfinance Survey Report covers the period 2016-2017 and consists of data collected from 156 surveyed MFIs across 28 European countries.

The report gives a sound image of the sector’s heterogeneity relating to the institutional model, the size, and the level of specialisation in microlending. The social goals pursued by microfinance institutions (MFIs) are also diverse, with a primary focus on financial inclusion and job creation.

The report highlights an increase of the scale of the sector both in terms of the total volume and the number of microloans disbursed. In 2017, the MFIs surveyed disbursed a total of 660,330 loans (+5% compared to 2016) with a total volume of EUR 2.1 billion(+11%).

Non-financial support is a key element of microfinance provision in Europe. In fact, almost 70% of the MFIs surveyed follow an integrated approach allowing for the provision of financial products (primarily business and personal microloans, SME loans, and savings) and non-financial services. Last year the MFIs canvassed reached 443,825 clients with their non-financial services (+5%), mostly delivered through one-on-one support (e.g. mentoring, coaching) and at no cost to the clients.

The report, a joint EMN and MFC initiative, was prepared by researchers of Social Innovation Teams (SIT) and Politecnico di Torino university.

- Download the infographic containing the key facts on microfinance in Europe:

- You can also read the Executive Summary in

Click here to download report